Real-Time Mobile Number Verification for India Stop SIM Swap & Fraud Instantly

Instantly detect how long any Indian mobile number has been active, stop SIM-swap fraud, strengthen credit risk models, and tailor offers with confidence.

Why Tenure Data is Business-Critical

First-day fraud is rising. Attackers activate new numbers to bypass OTP-based verification, and SIM-swap scams spike after a number changes hands.

But here’s the problem

Real-Time Detection Gap

Most systems can’t detect this activity in real time.

Compliance Pressure

DoT's KYC tightening now demands granular metadata during onboarding.

Rising Fraud Costs

SIM-swap fraud costs Indian businesses millions annually in lost revenue.

The Solution

SIM-Age API by Neokred

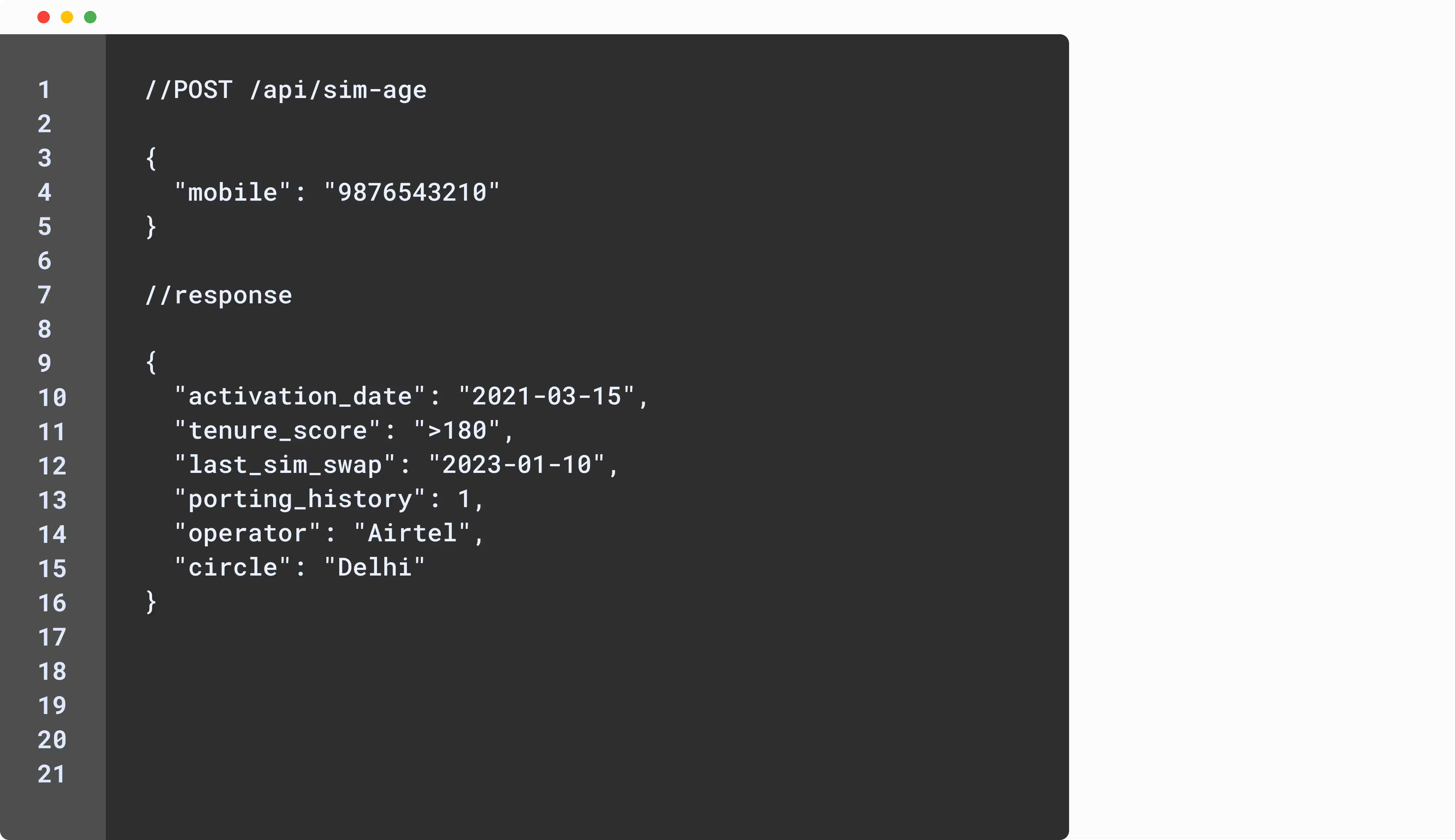

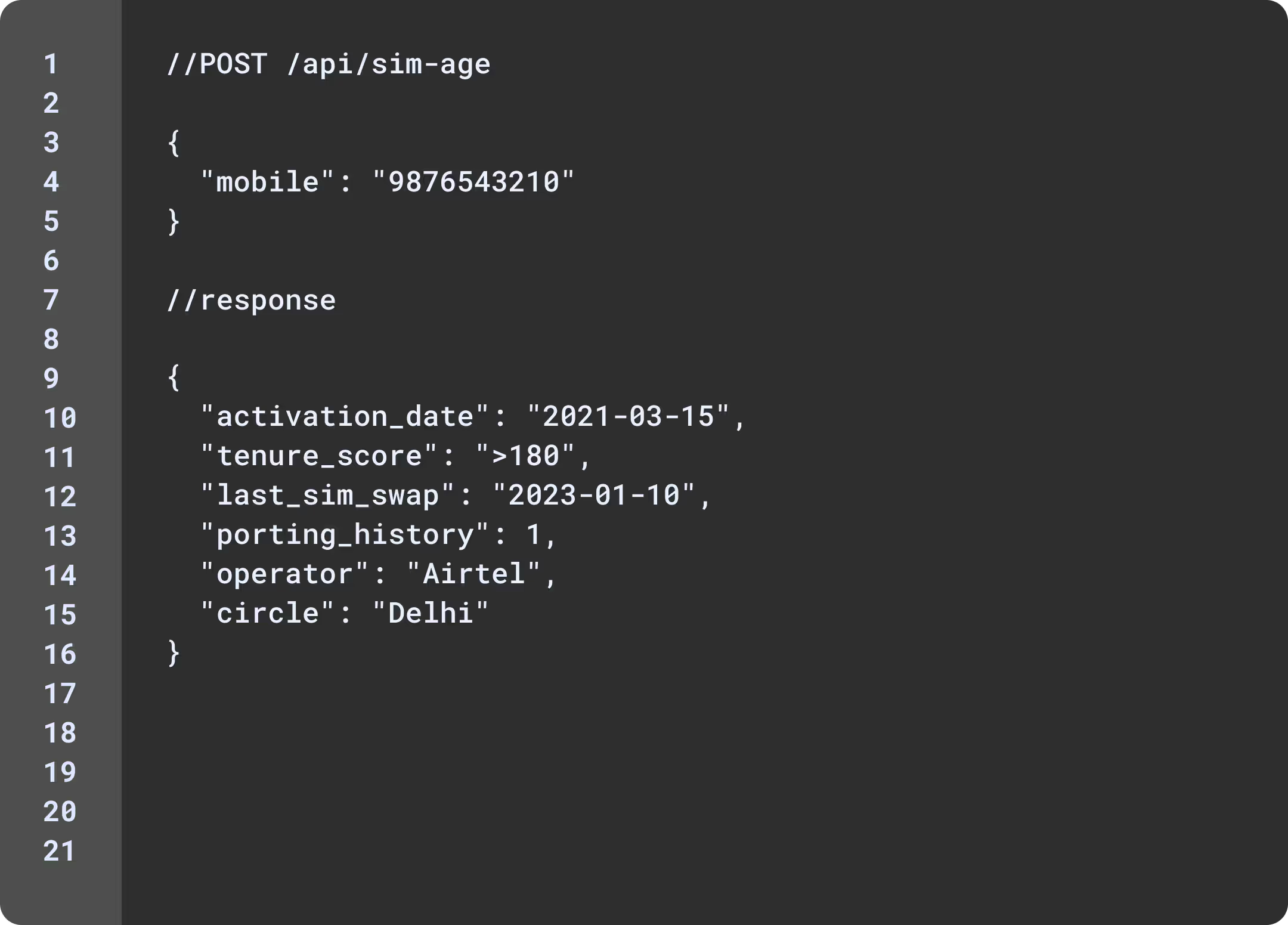

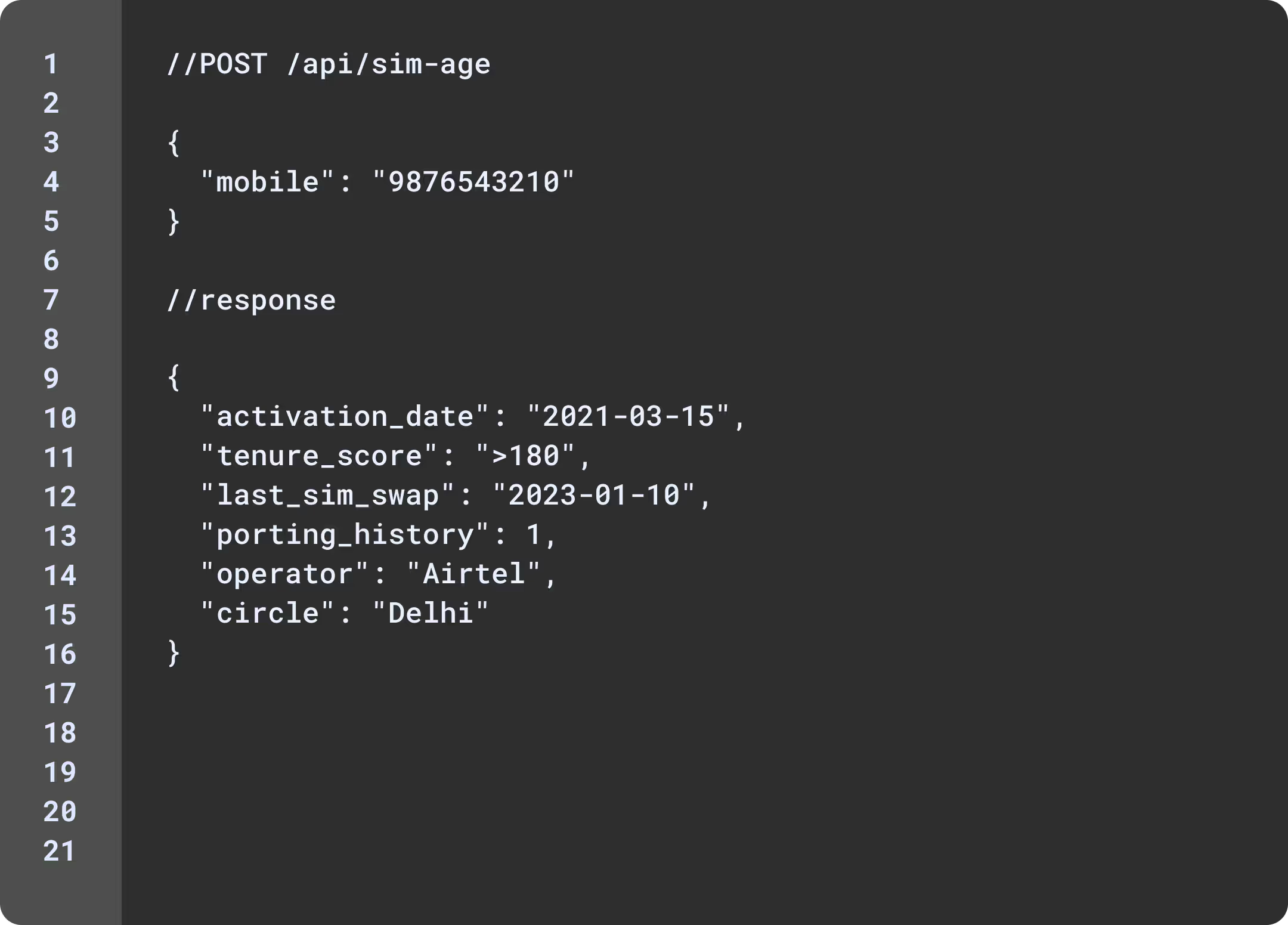

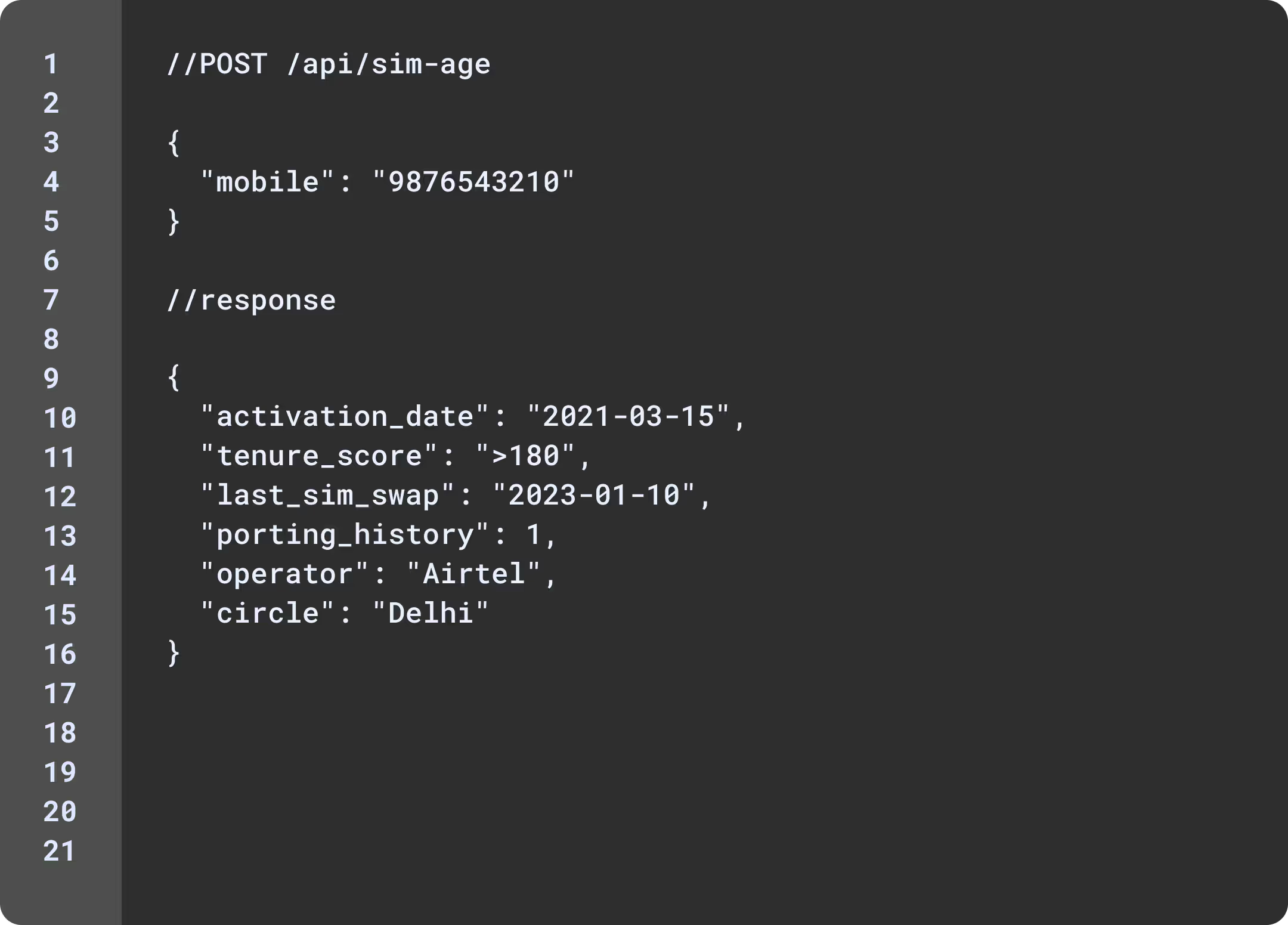

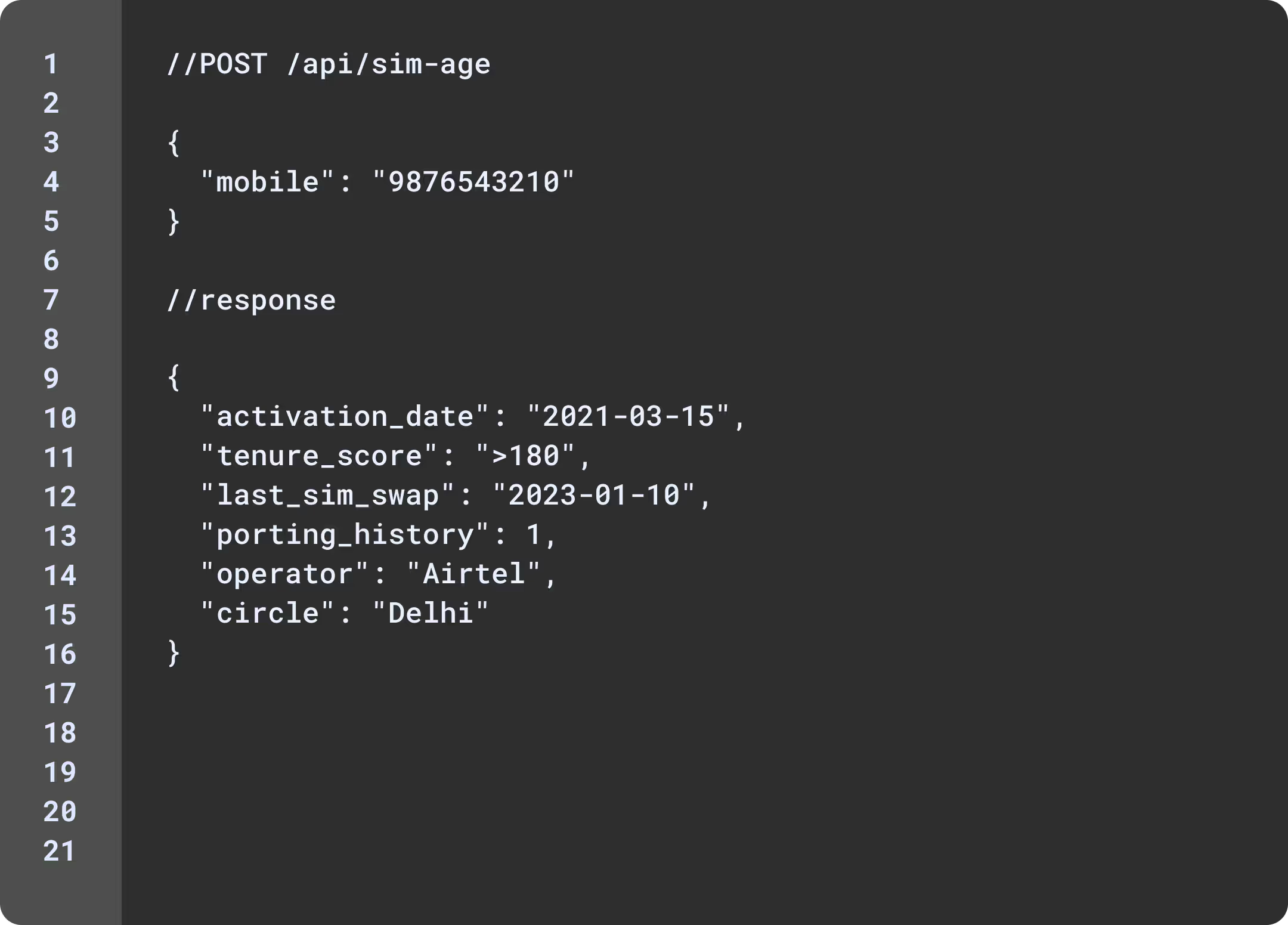

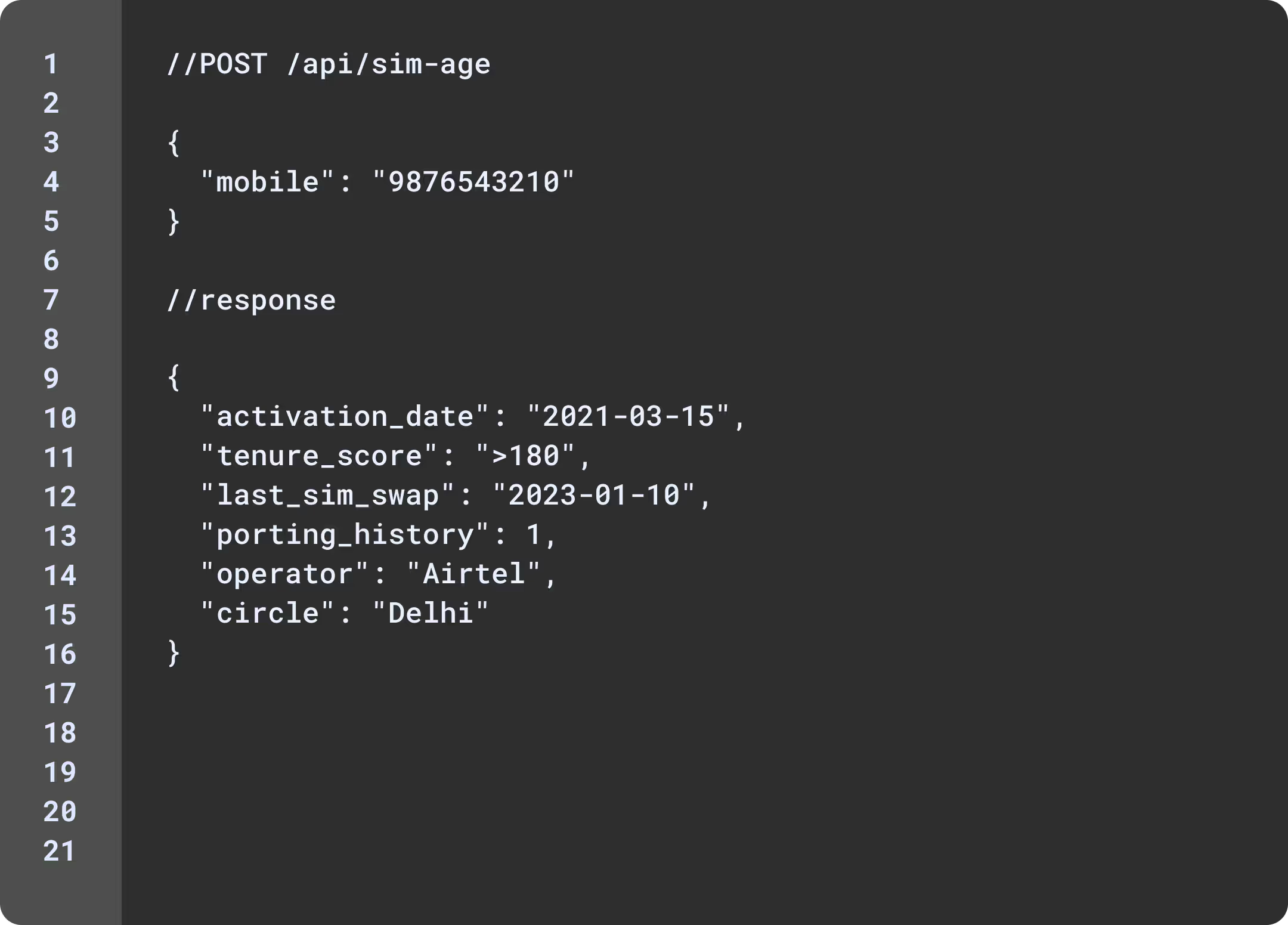

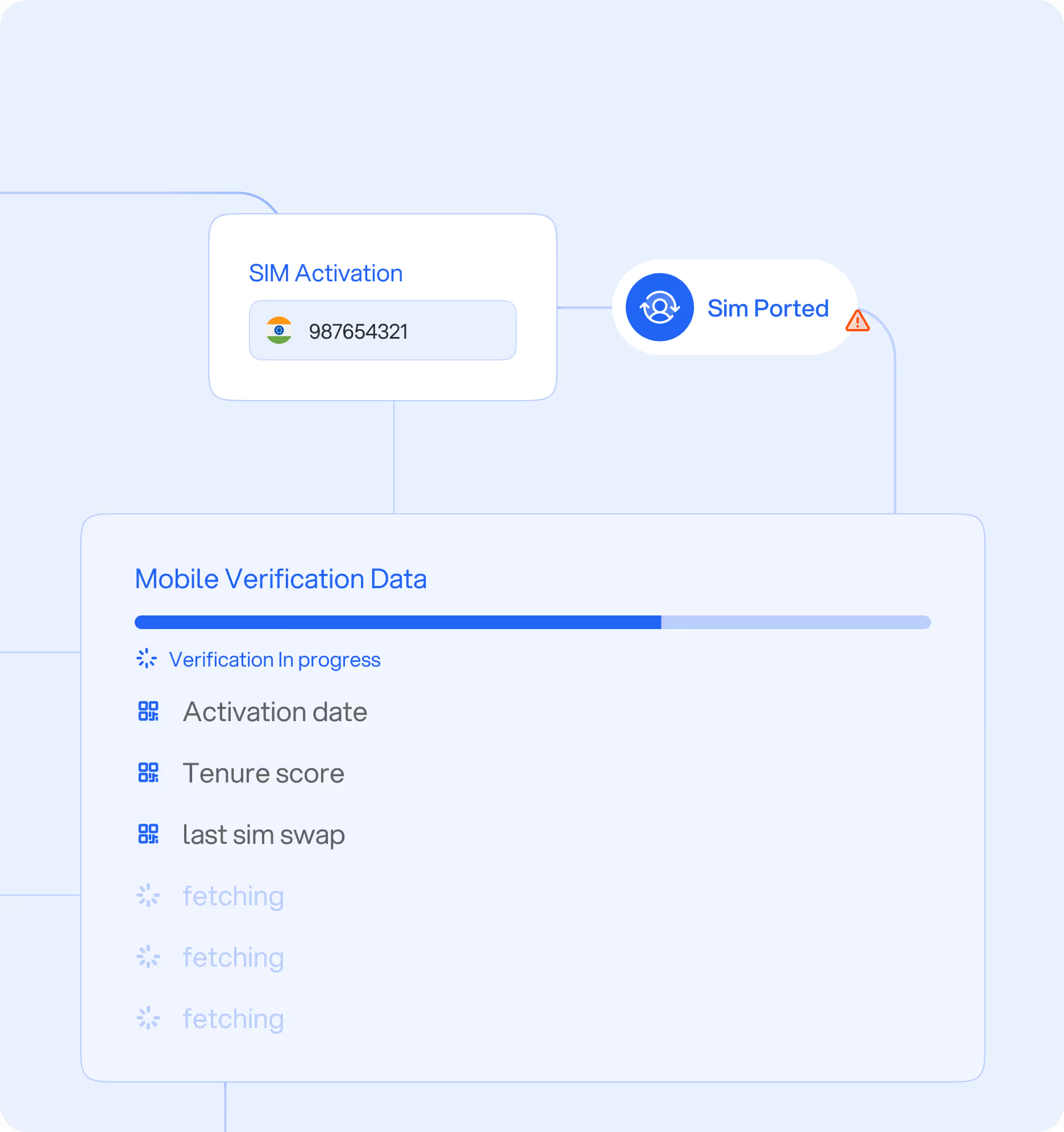

Input any 10-digit Indian mobile number. Get back a structured, telco-sourced JSON with comprehensive metadata. All processed via direct telco integrations and Sanchar Saathi-compliant workflows.

SIM-Age API

Fetch SIM activation, tenure, porting, and swap history in real-time from verified telco sources.

SIM-Age API

Fetch SIM activation, tenure, porting, and swap history in real-time from verified telco sources.

SIM-Age API

Fetch SIM activation, tenure, porting, and swap history in real-time from verified telco sources.

SIM-Age API

Fetch SIM activation, tenure, porting, and swap history in real-time from verified telco sources.

SIM-Age API

Fetch SIM activation, tenure, porting, and swap history in real-time from verified telco sources.

Core Features

Core Infrastructure for Mobile Identity Trust

Detect tenure, SIM swaps, porting history, and operator meta data with sub-second speed—fully compliant and ready to deploy.

Real-Time Telco Lookup

Direct carrier signalling delivers <2s latency

Tenure-Based Risk Scoring

Flag high-risk new numbers (<7 days old)

Continuous Monitoring

Get alerts on frequent SIM swaps or port-outs

Pan-India Coverage

Unified consent flow across all Indian operators

Built for Compliance

Fully DPDP & TRAI compliant; no data retention

Why India's Leading Fintechs & Banks Choose Neokred

Faster Credit Decisions

Use tenure scoring to enhance risk models

Lower Fraud Losses

Spot new/port-out SIMs before they cause damage

Better Personalization

Identify loyal vs. first-time users in seconds

Lightning-fast

Use tenure scoring to enhance risk models

Secure-by-design

Spot new/port-out SIMs before they cause damage

Modular & Scalable

Identify loyal vs. first-time users in seconds

Compliance Made Simple

Plug-and-play readiness for KYC, TRAI & DPDP